To help financial advisors and investors address their diverse needs, we offer our ETF and Tactical Allocation Model portfolio strategies in a range of equity and fixed income allocations. All our Model Portfolio strategies provide a range of exposure to domestic and international stocks and bonds.

Our ETF and Tactical Allocation Model portfolios are managed in the context of the current market environment and consider the outlook for expected returns and expected volatility for asset sectors. We actively adjust allocation in portfolios based on independent and ongoing economic and securities research.

Models are designed to capture the equity market basis, encompassing over 18,000 global stocks. Models are also designed with diversified investment-grade and high-yield bond exposure to capture market movement in interest rates over a universe of about 8,000 fixed income funds.

Using our proprietary Risk Scoring calculation, we can manage a portfolio to a specific risk tolerance level that matches the client’s appetite for risk in their investments.

We aim to keep expense ratios low across our model portfolios, with weighted average expense ratios as low as 0.05%.

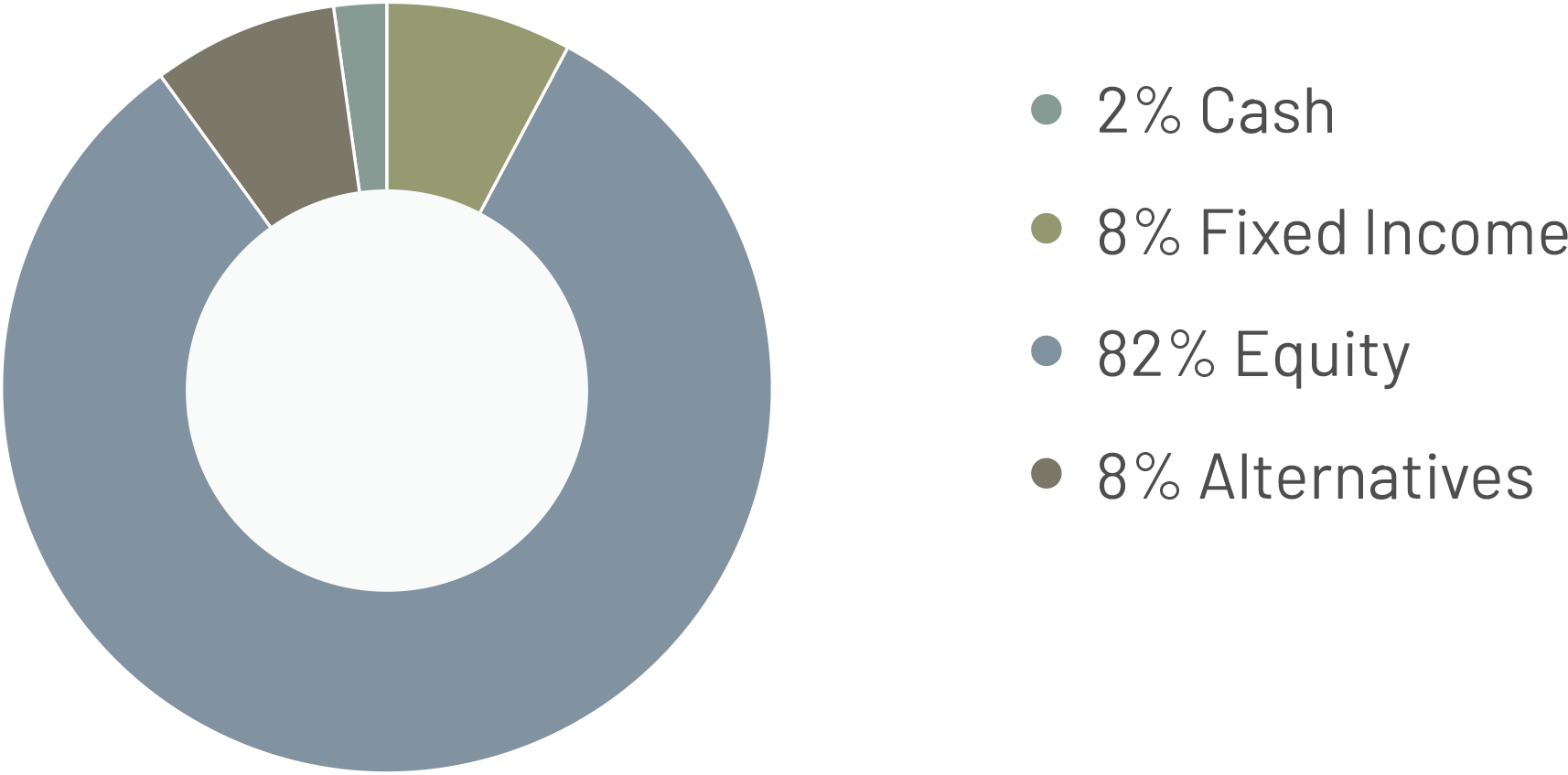

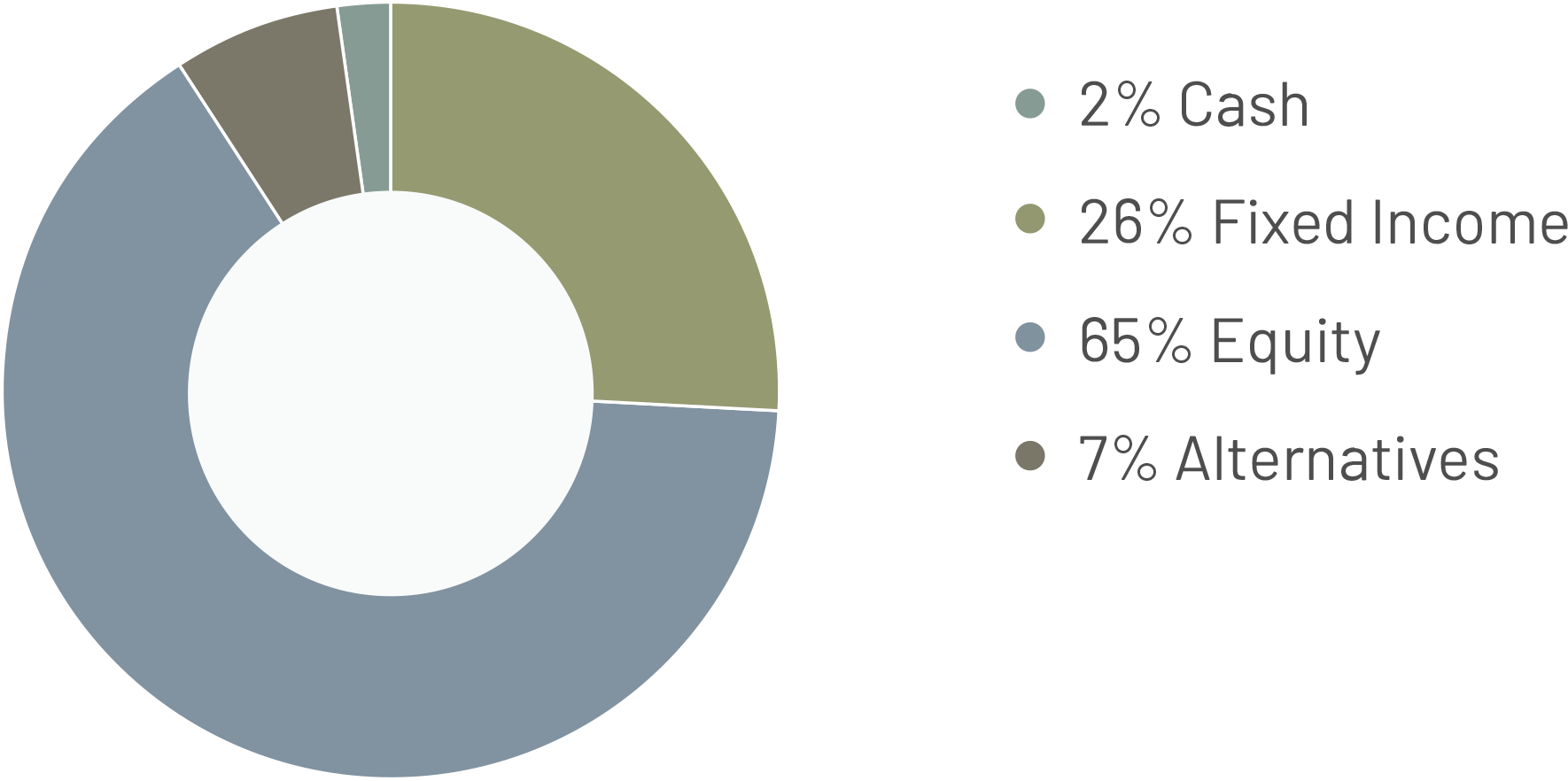

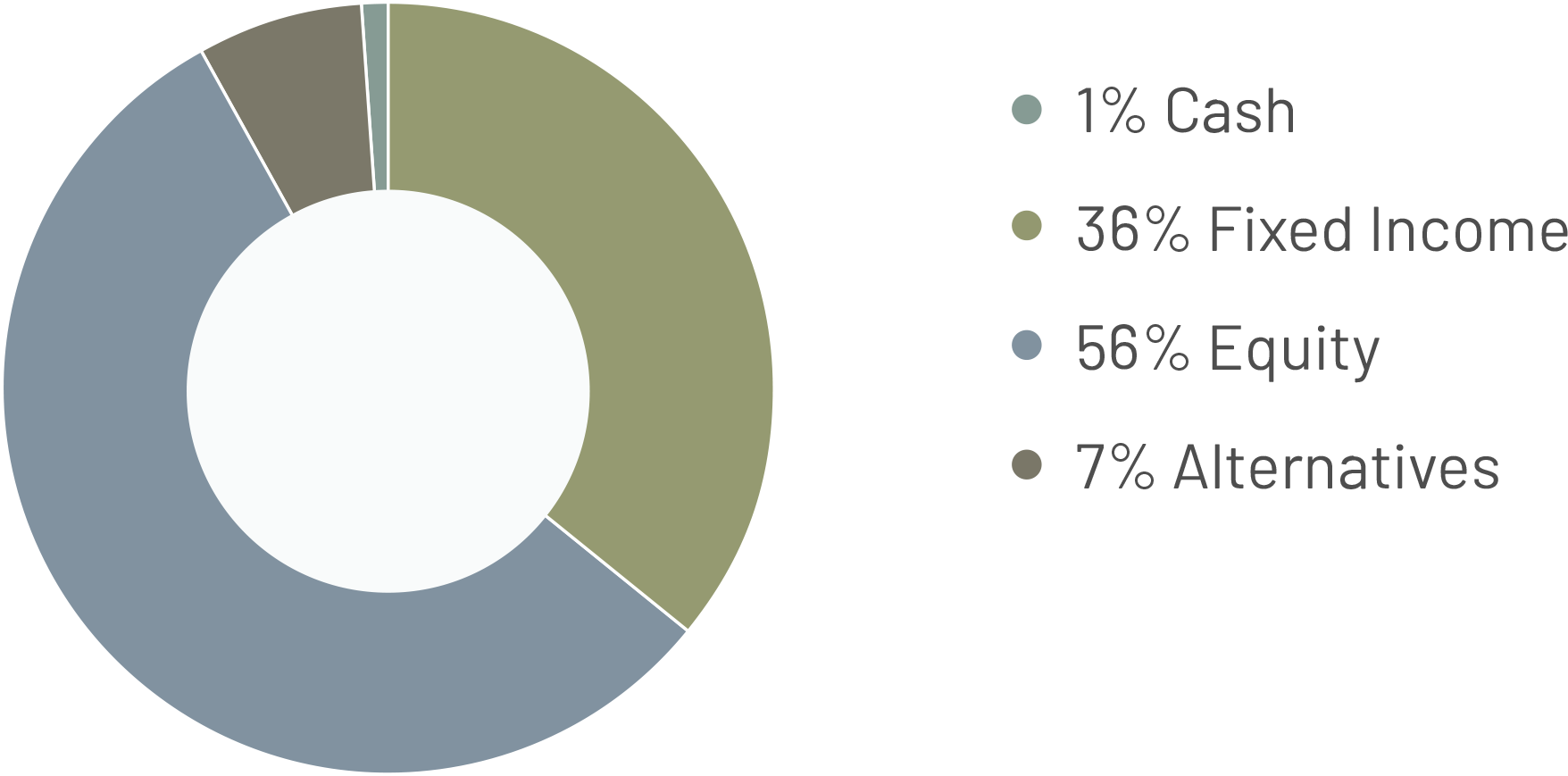

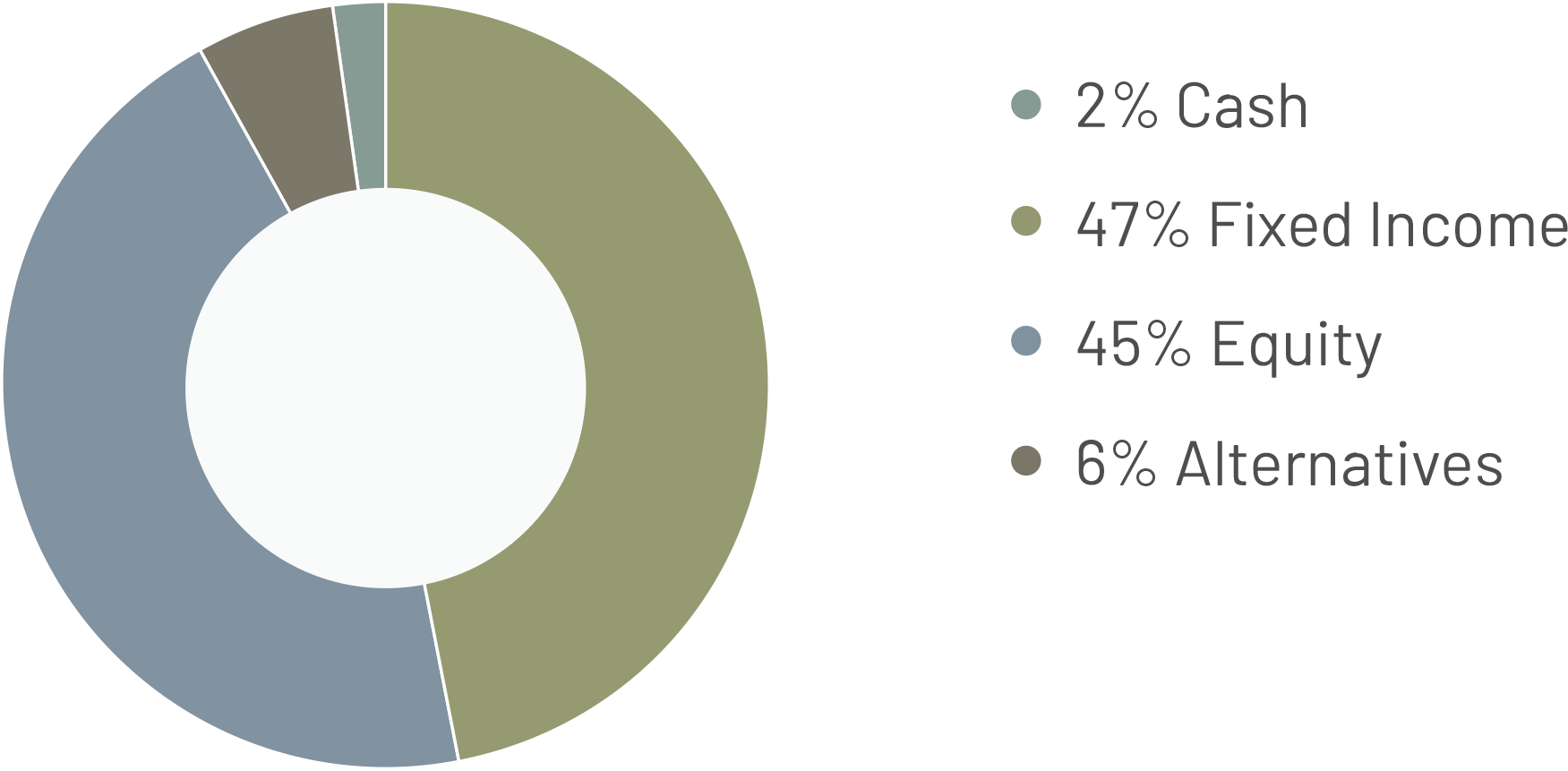

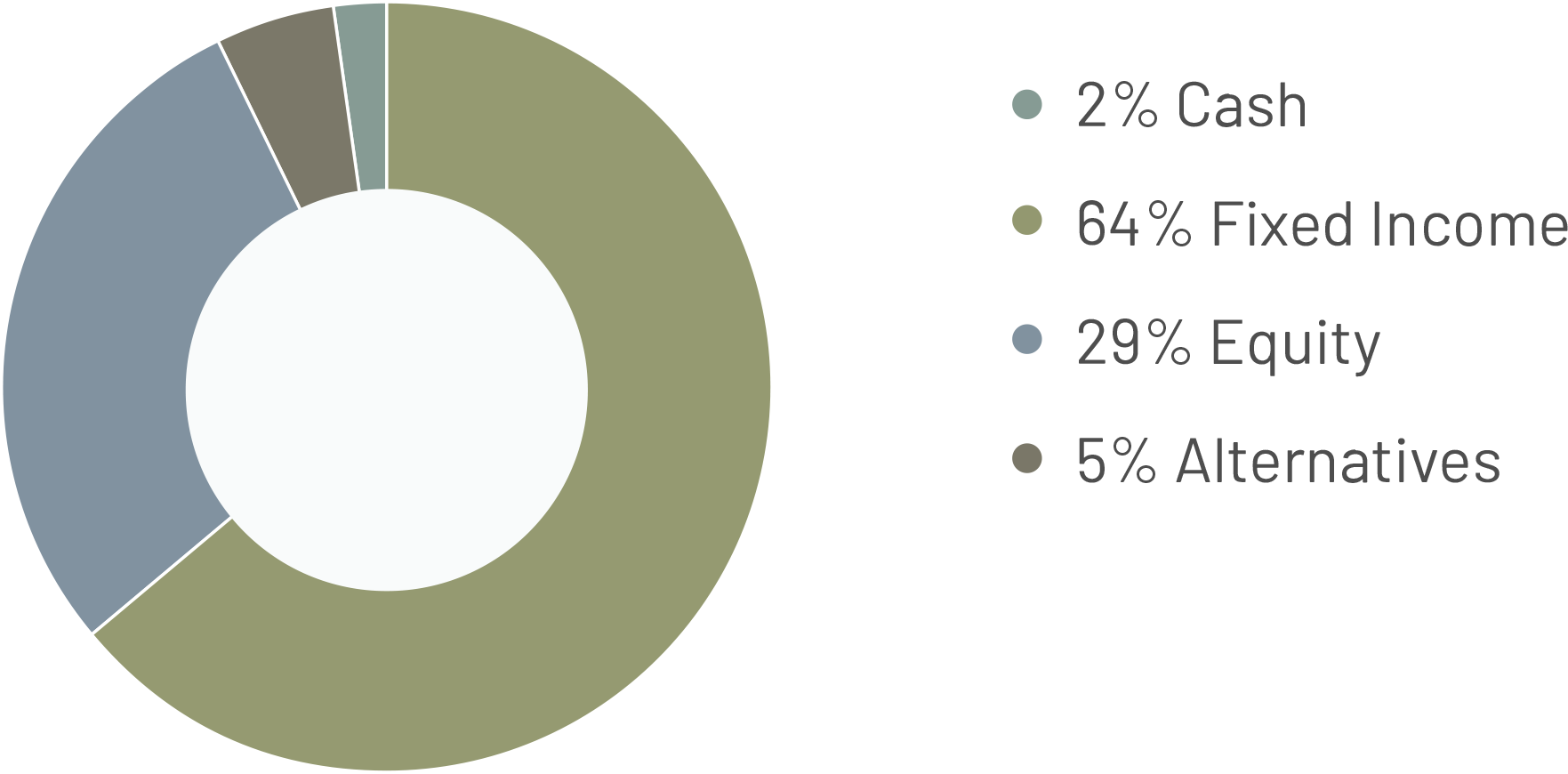

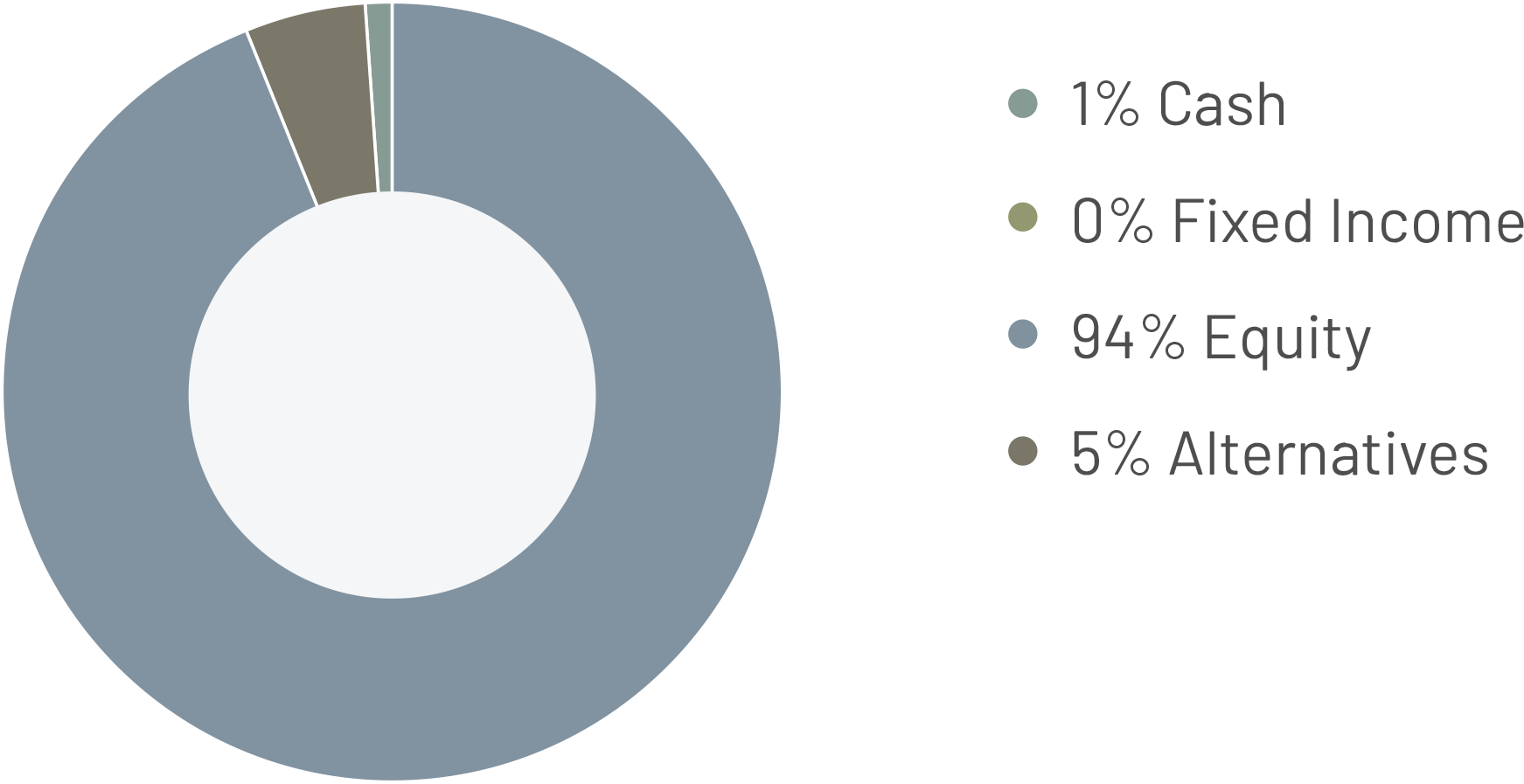

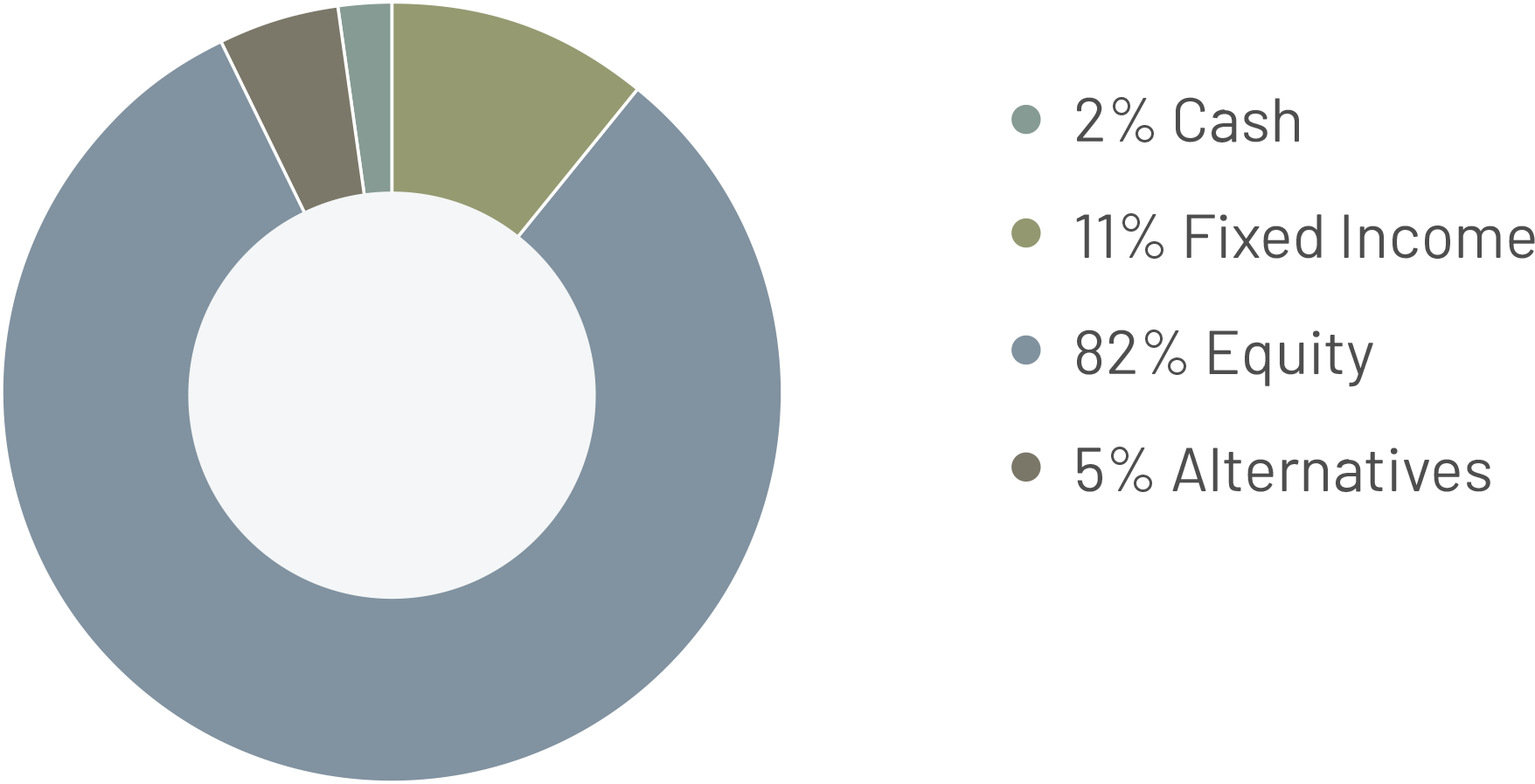

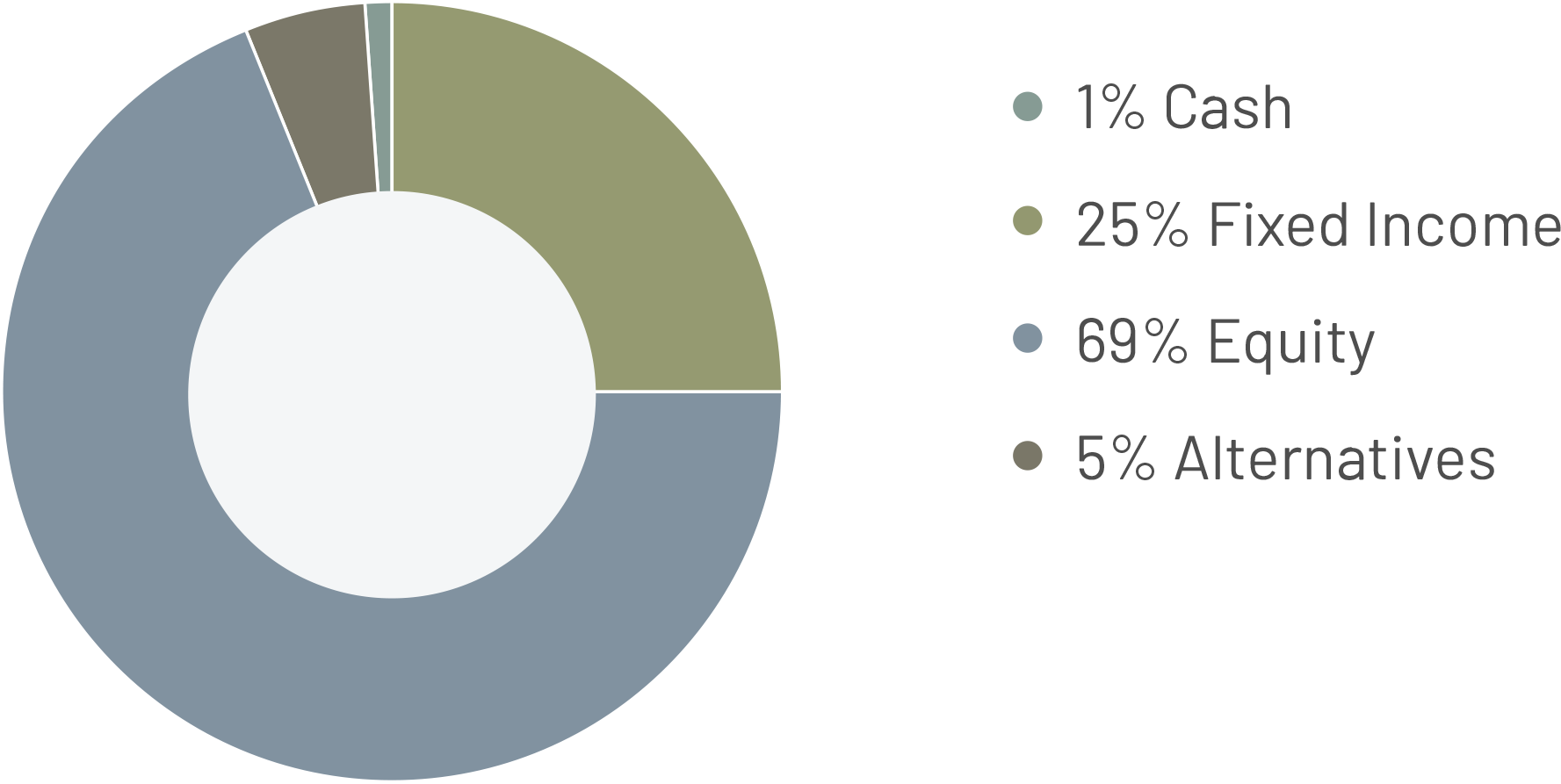

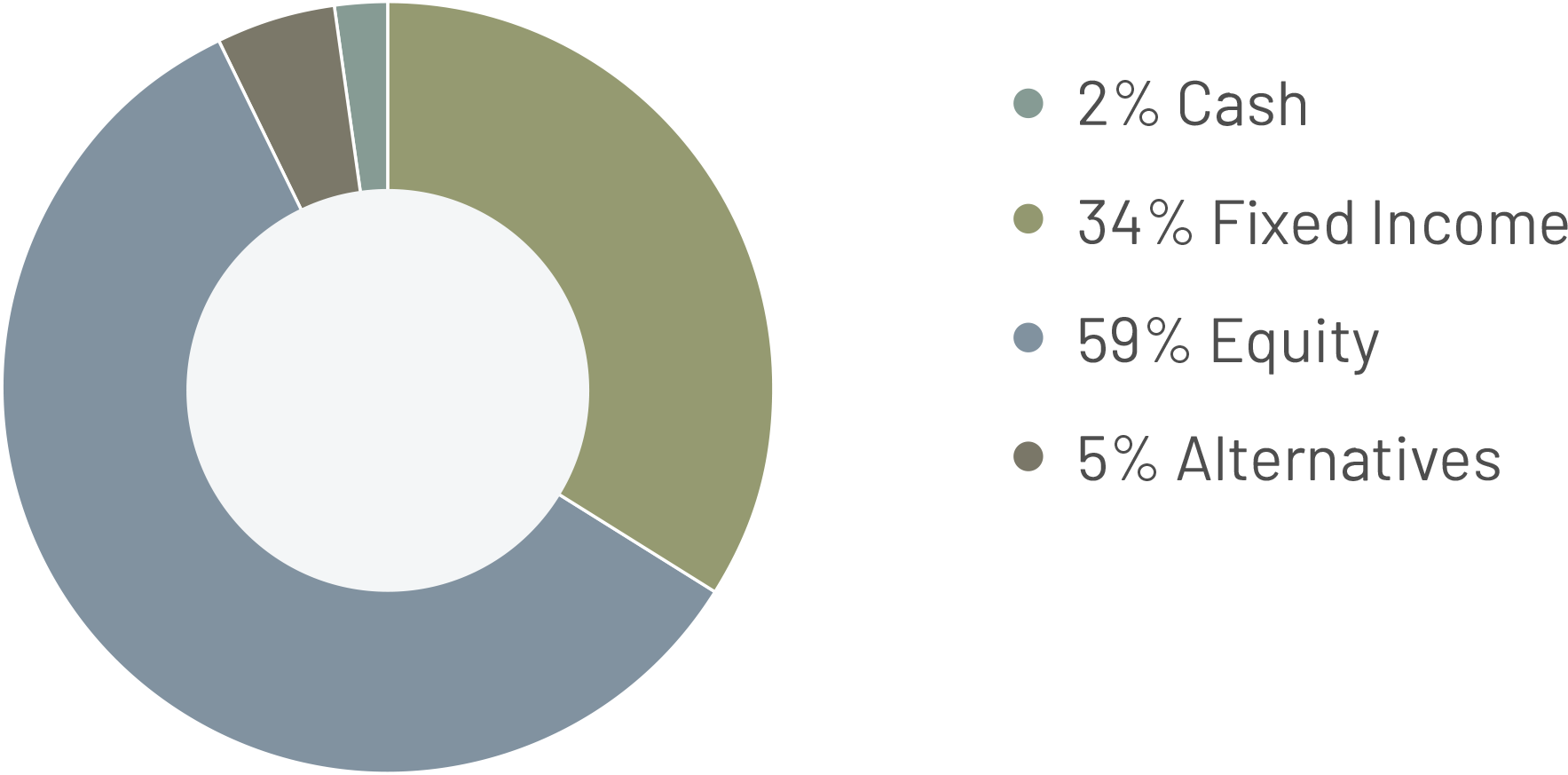

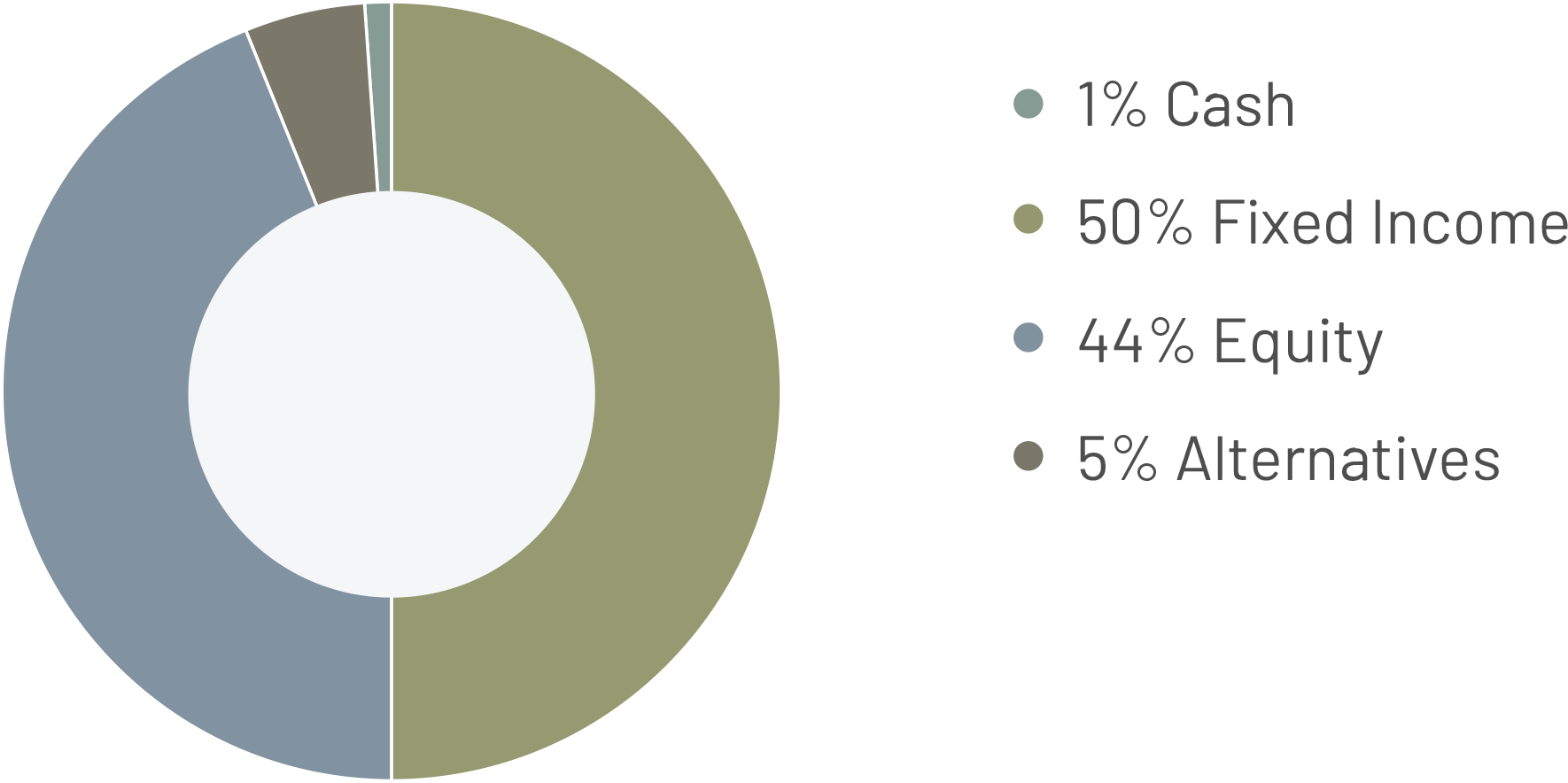

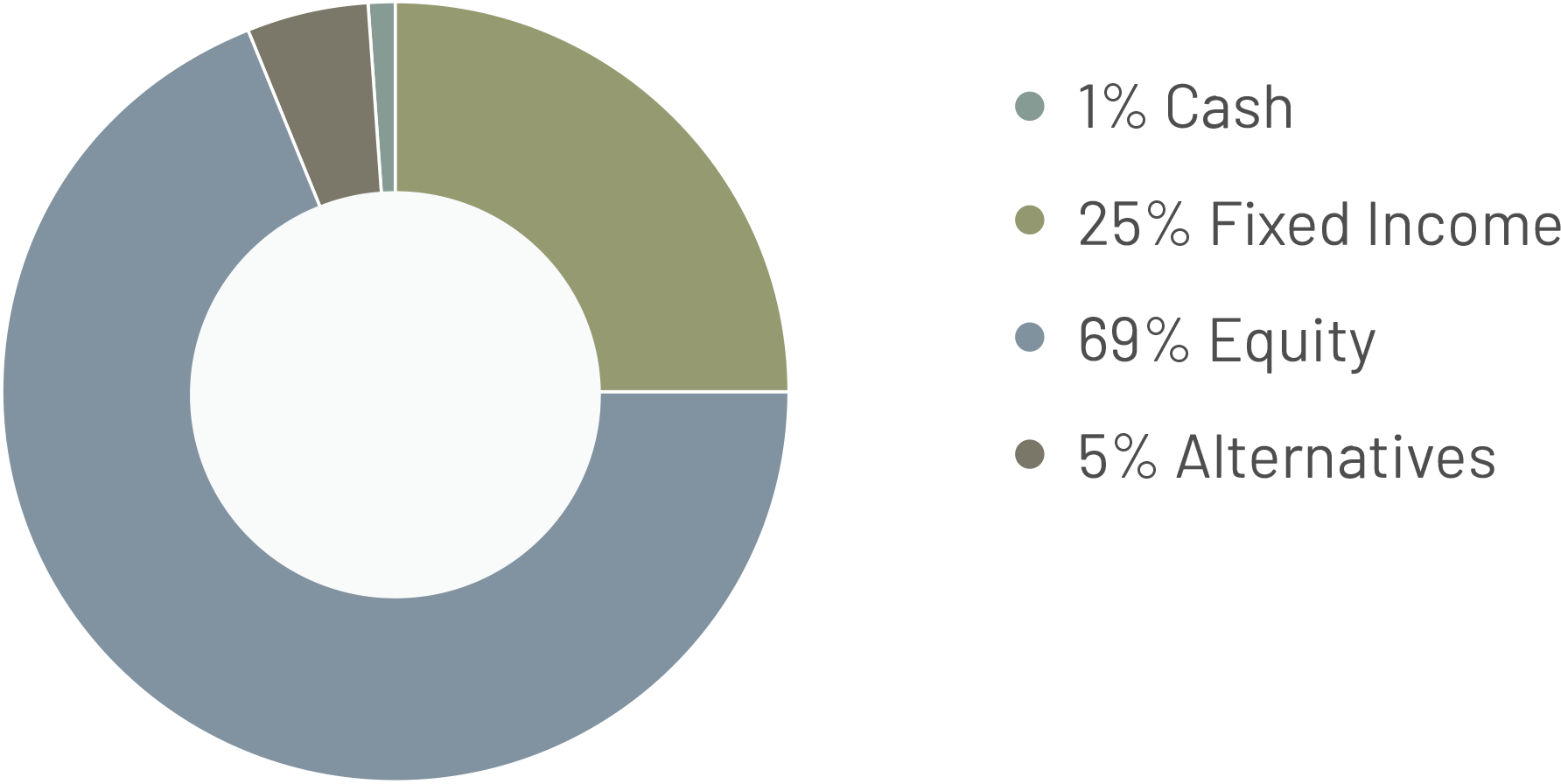

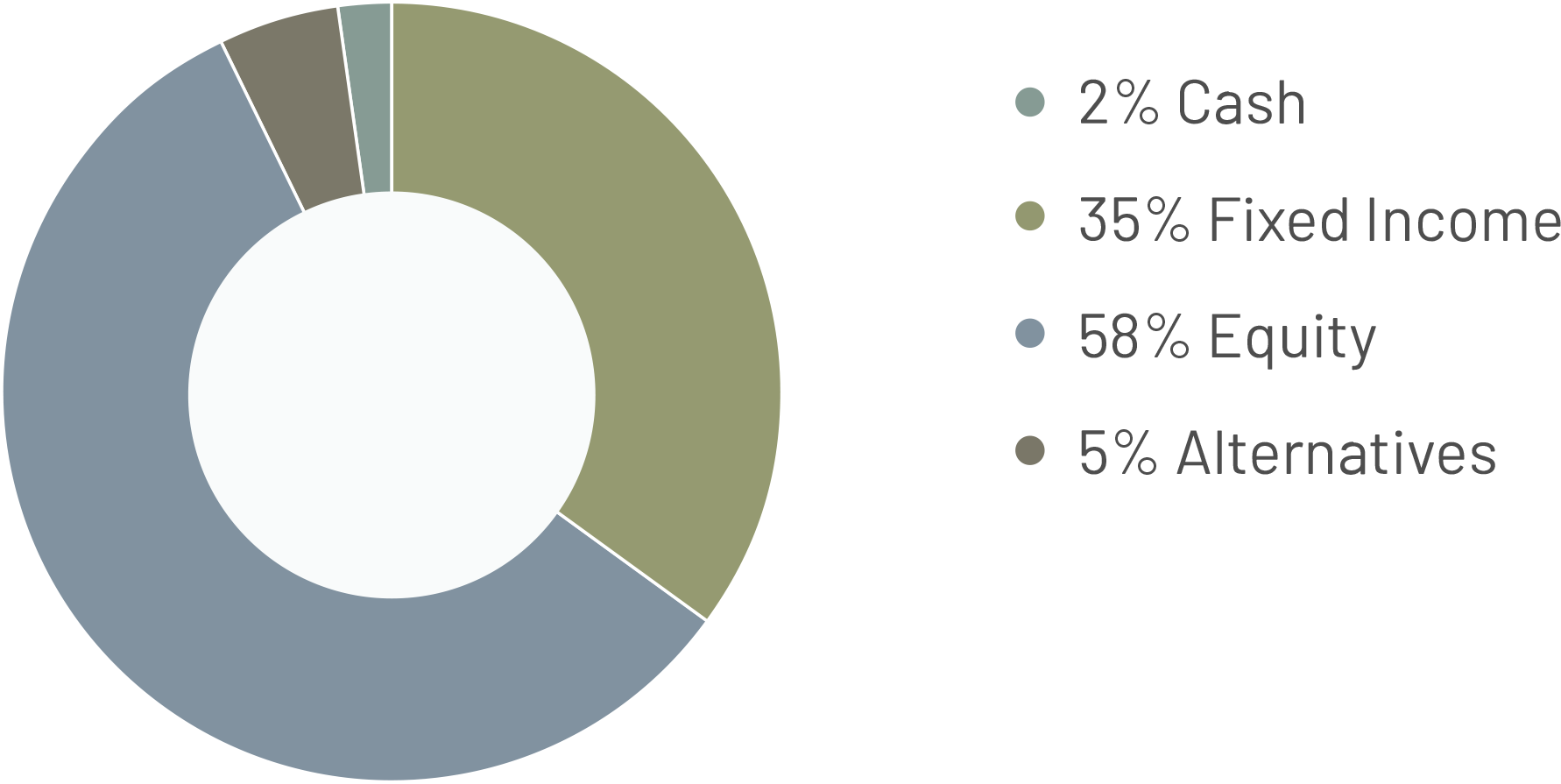

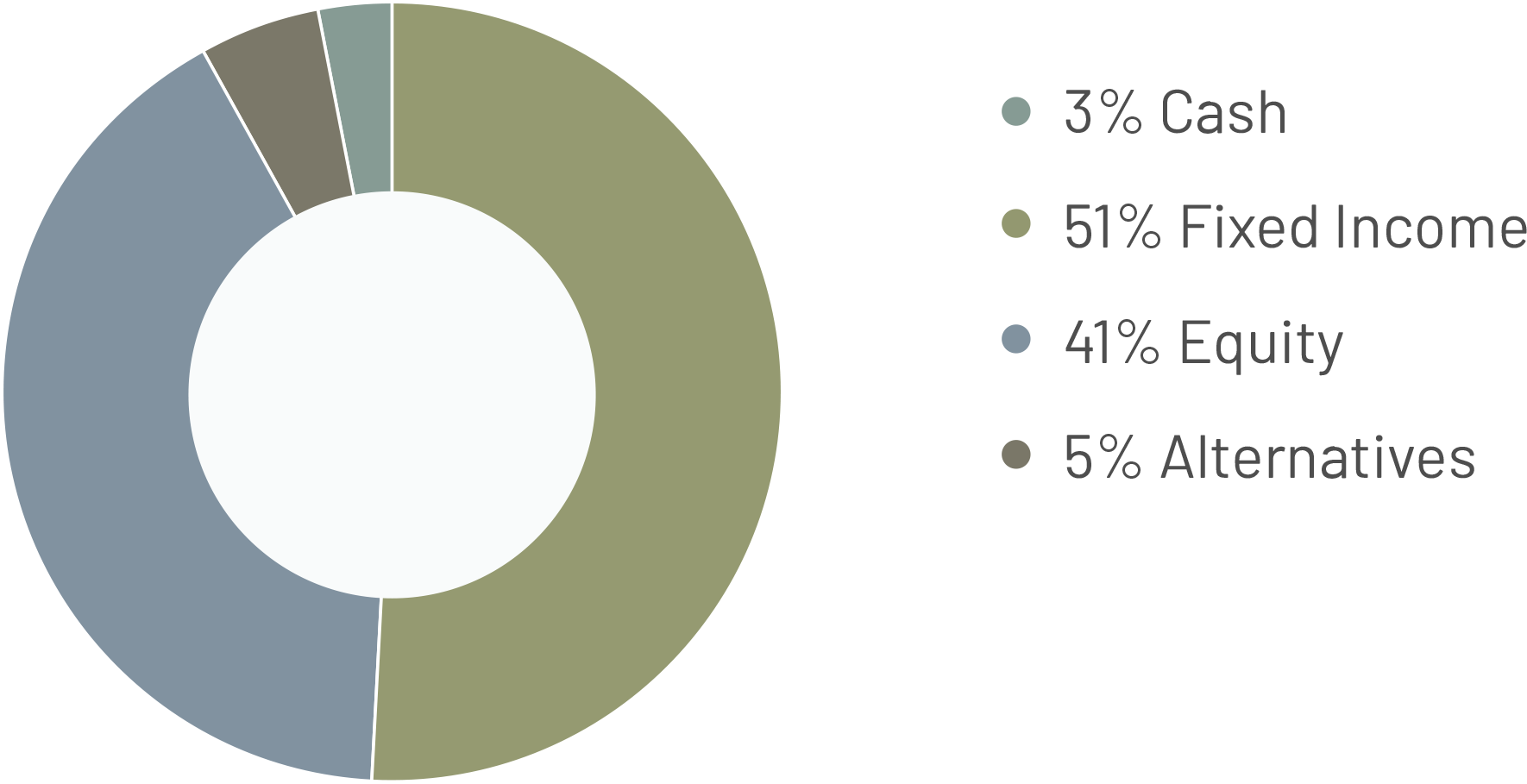

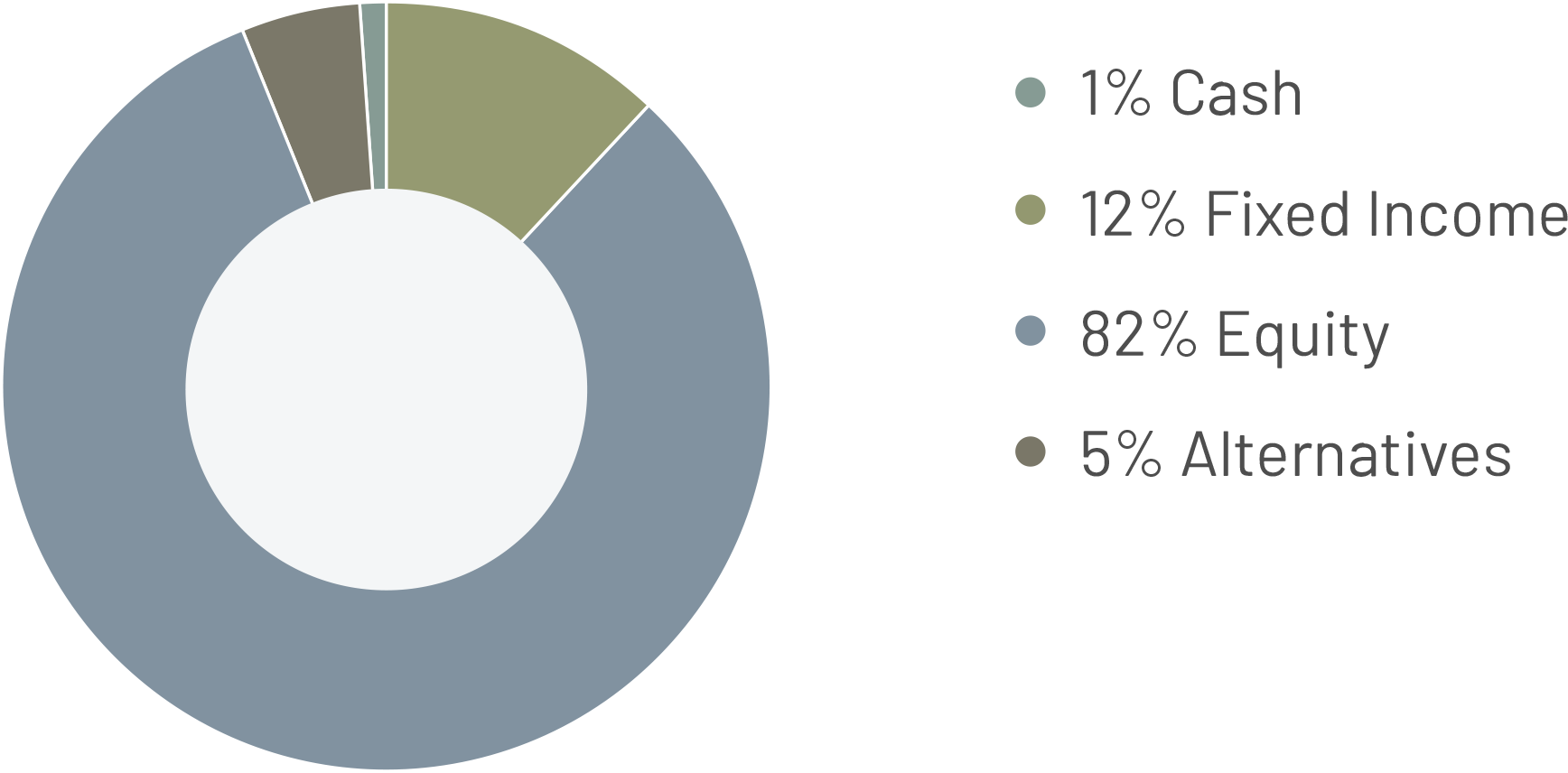

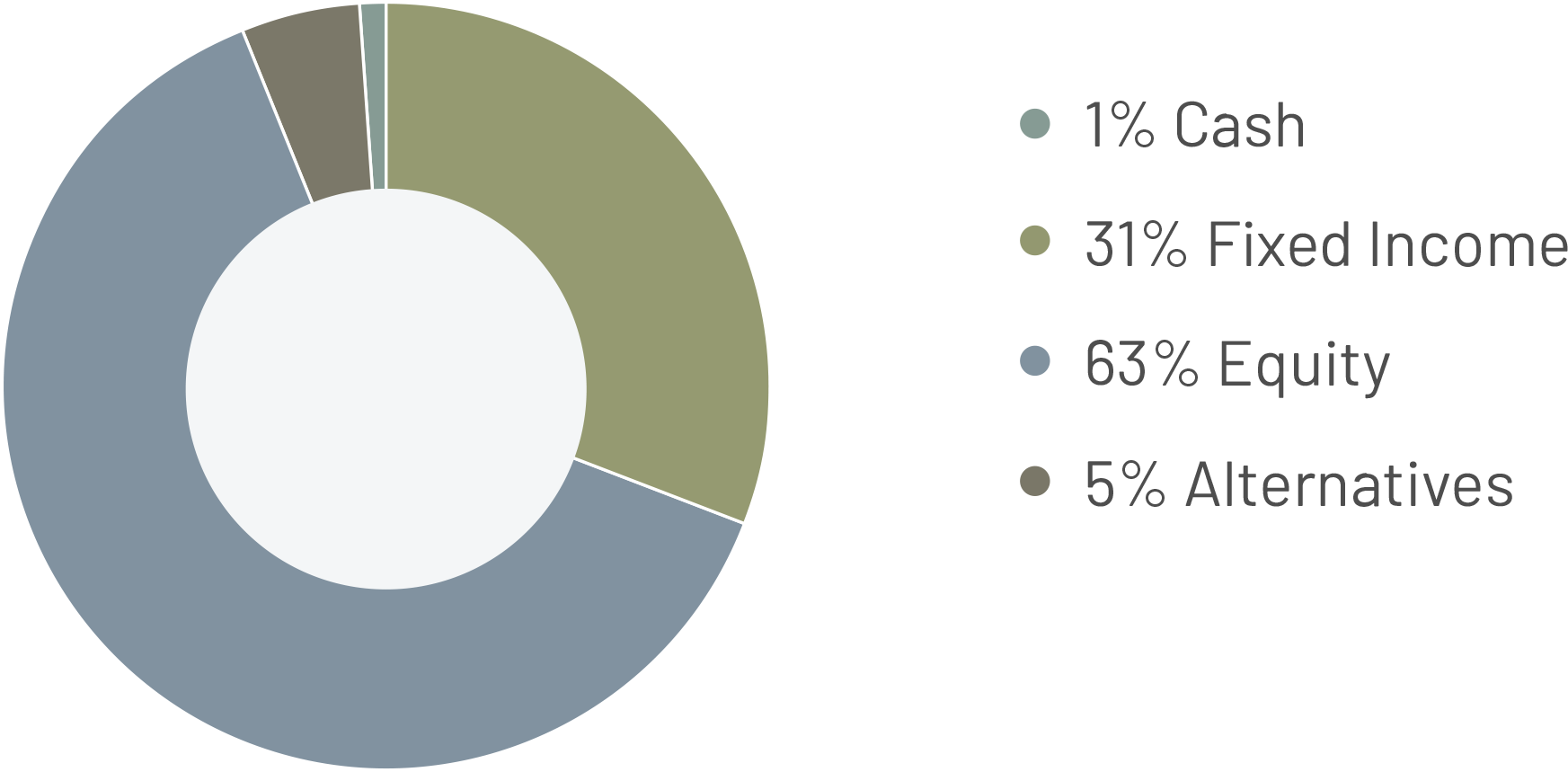

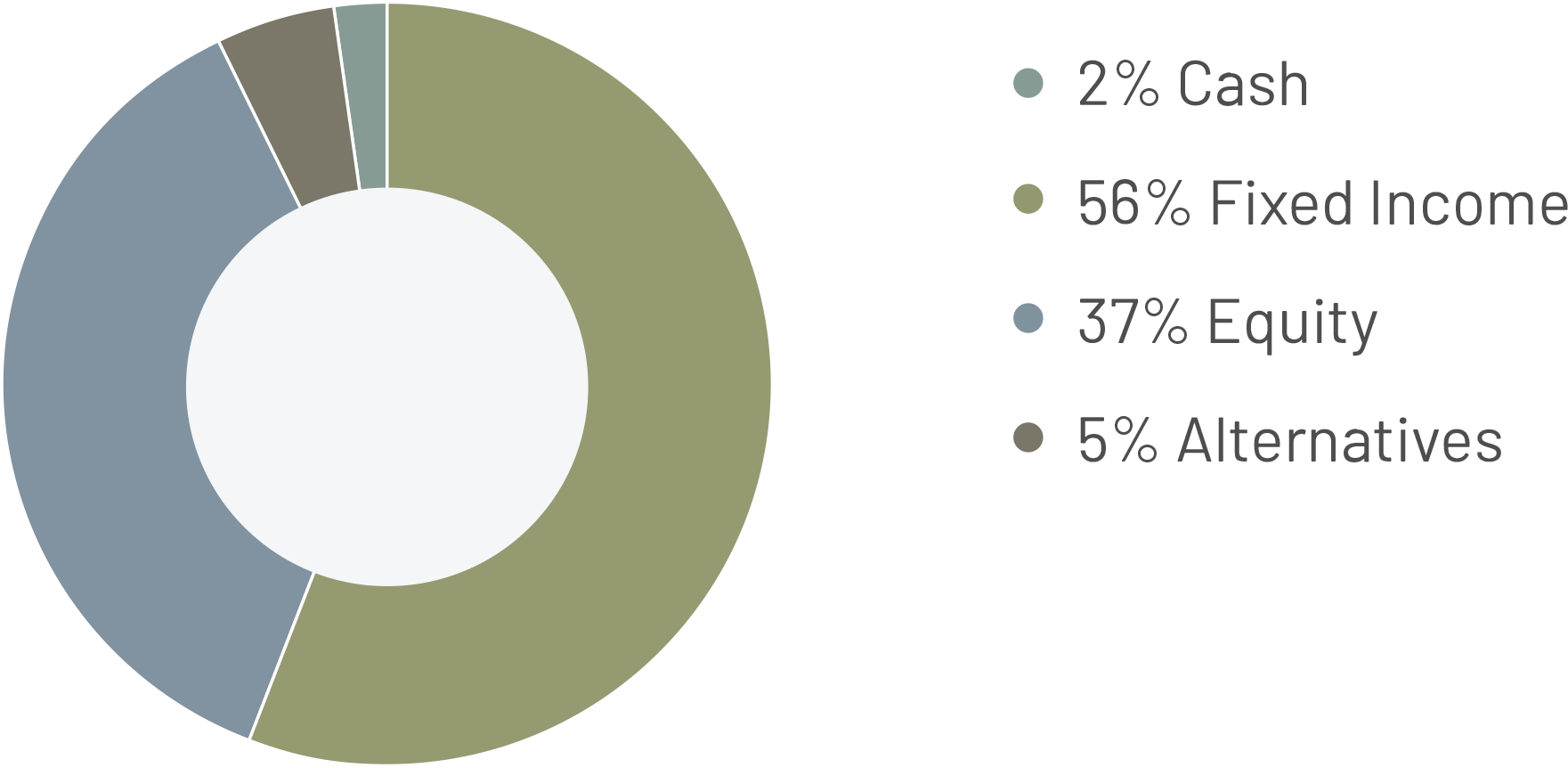

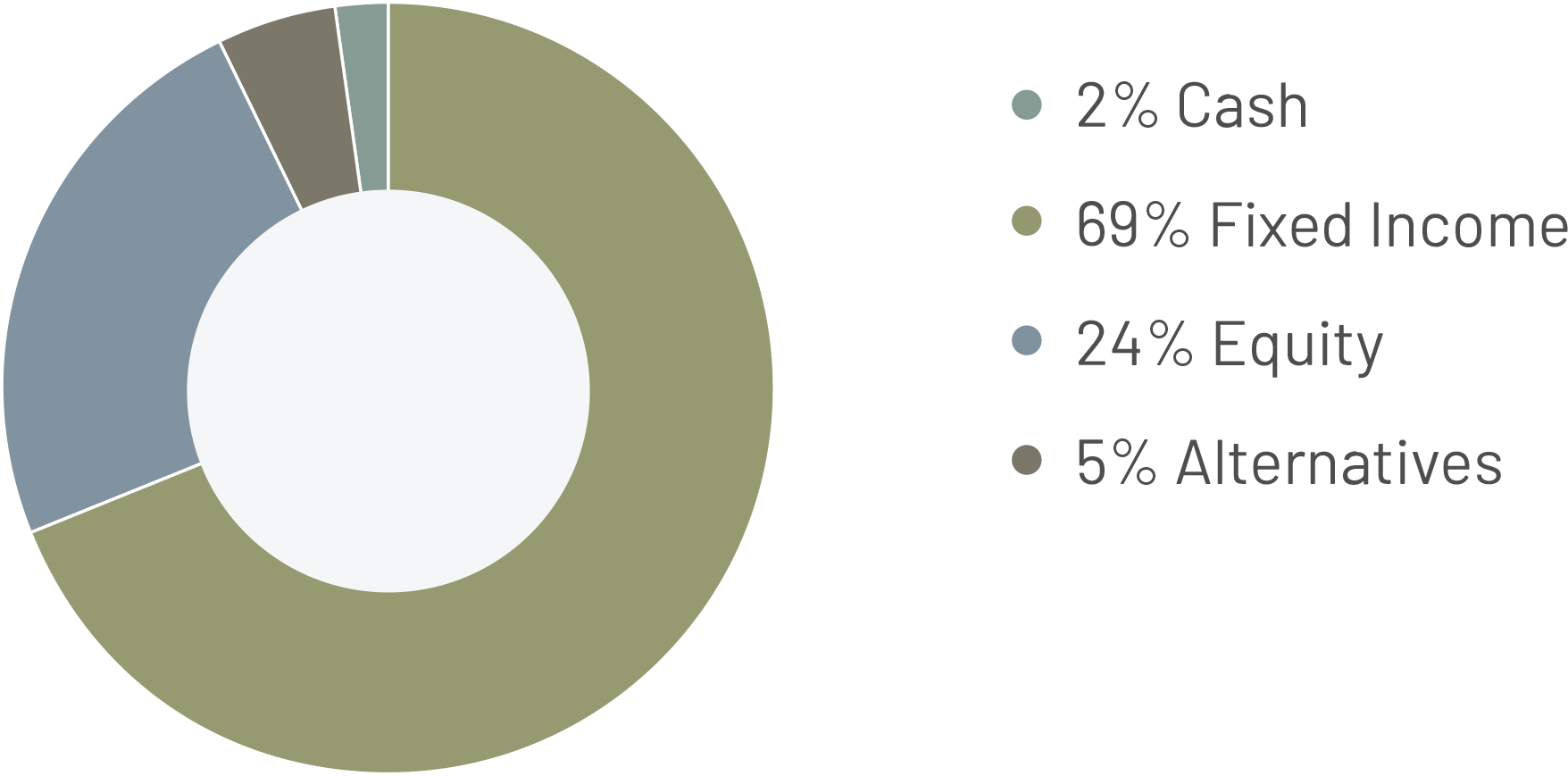

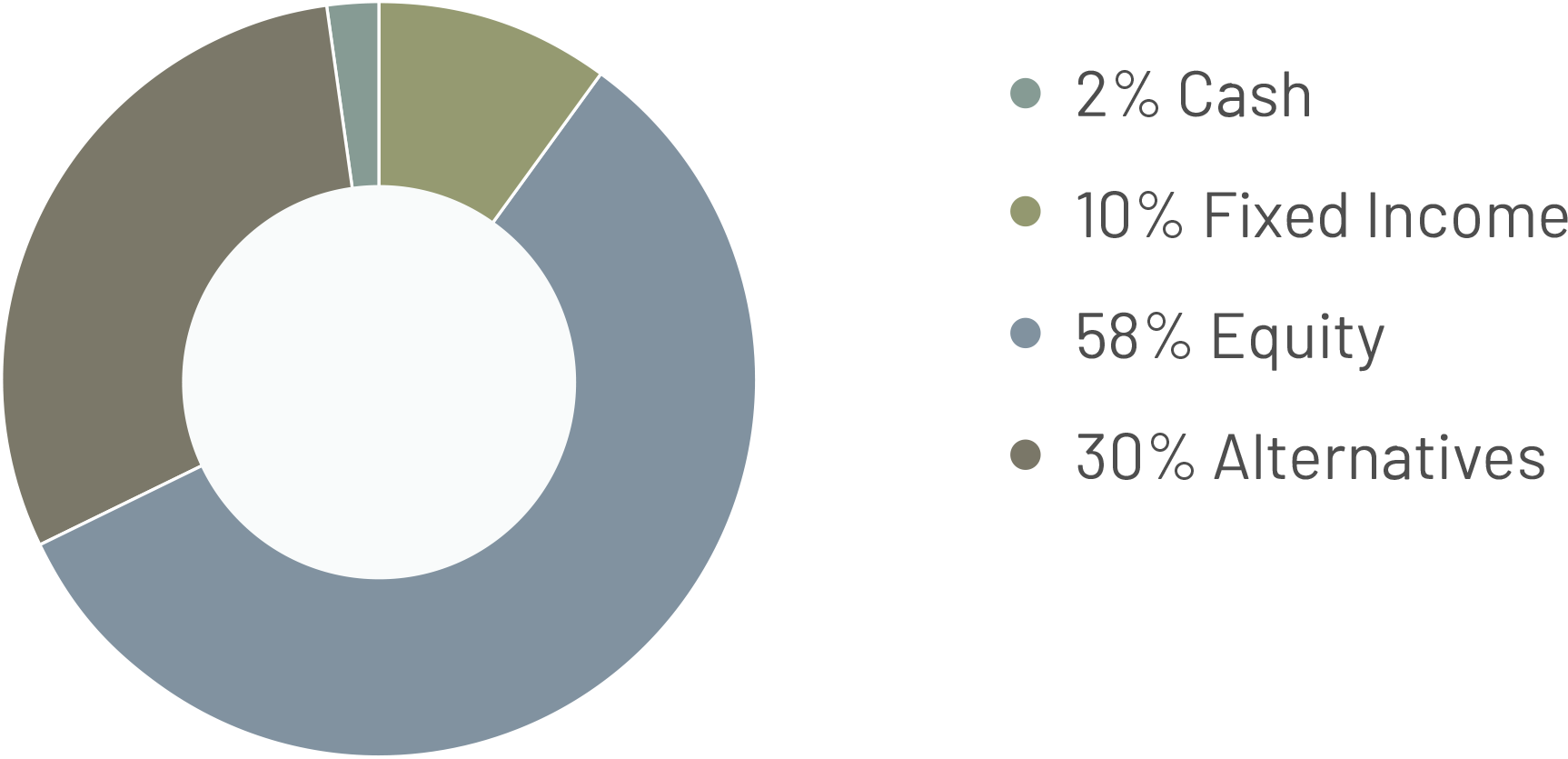

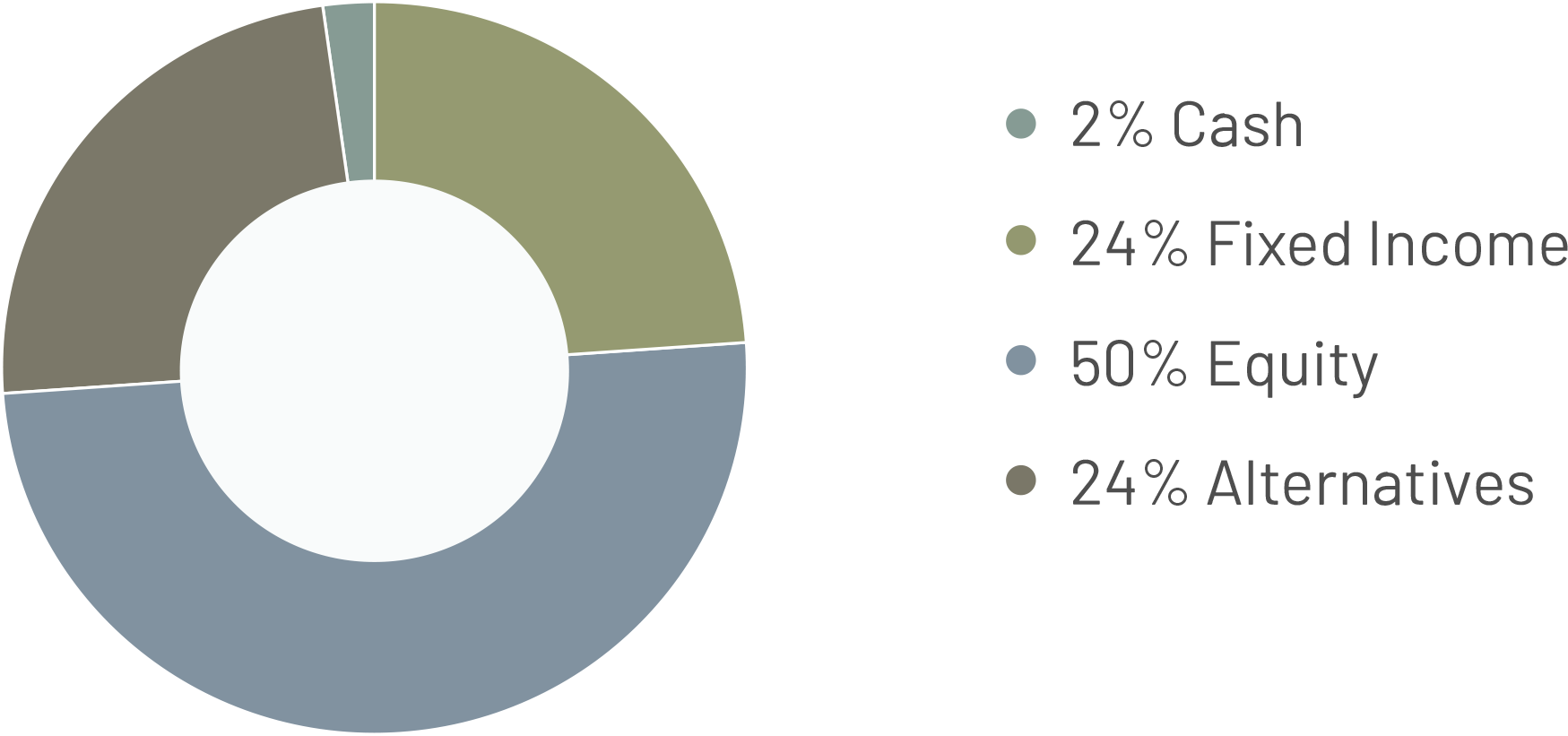

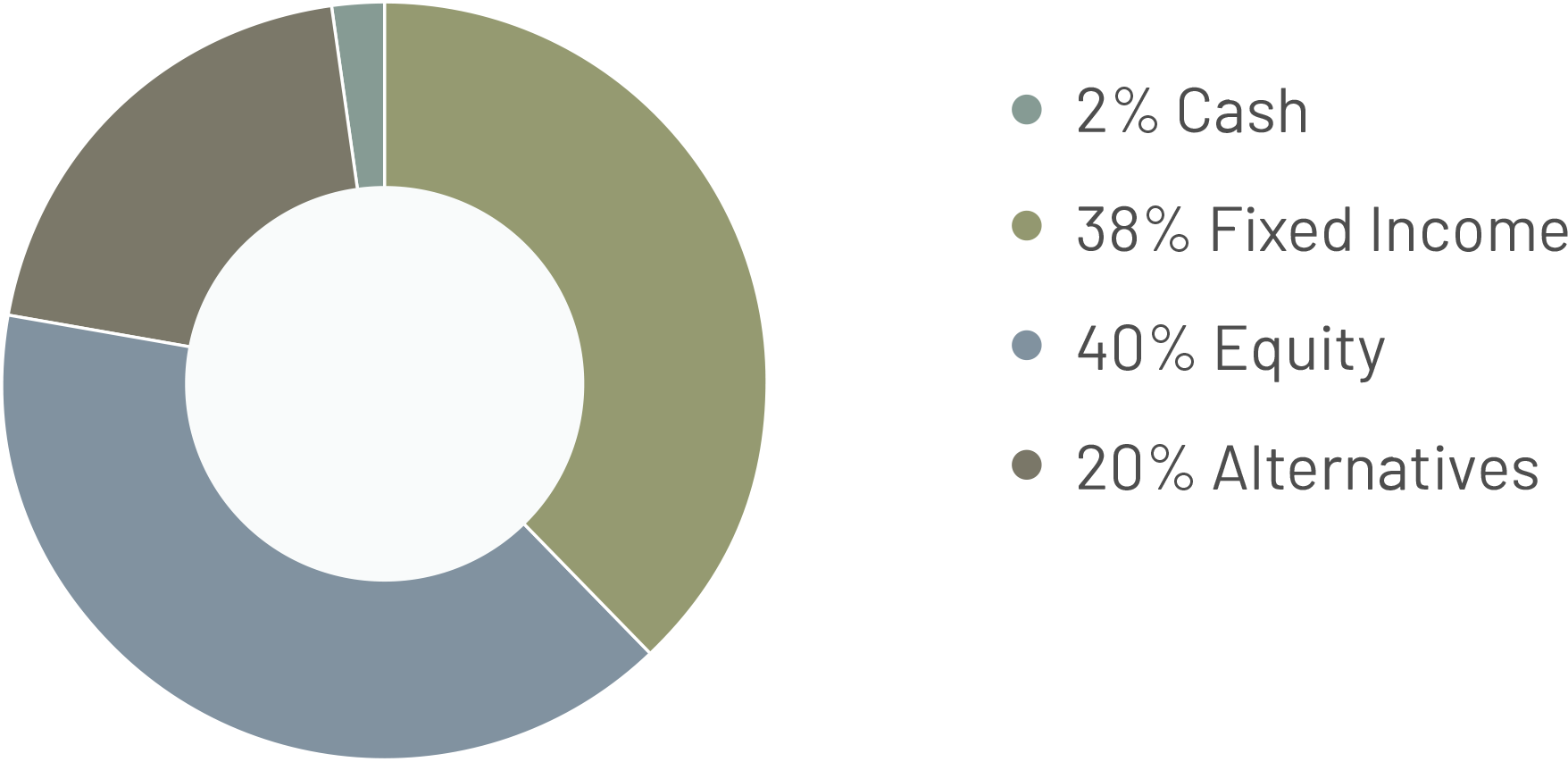

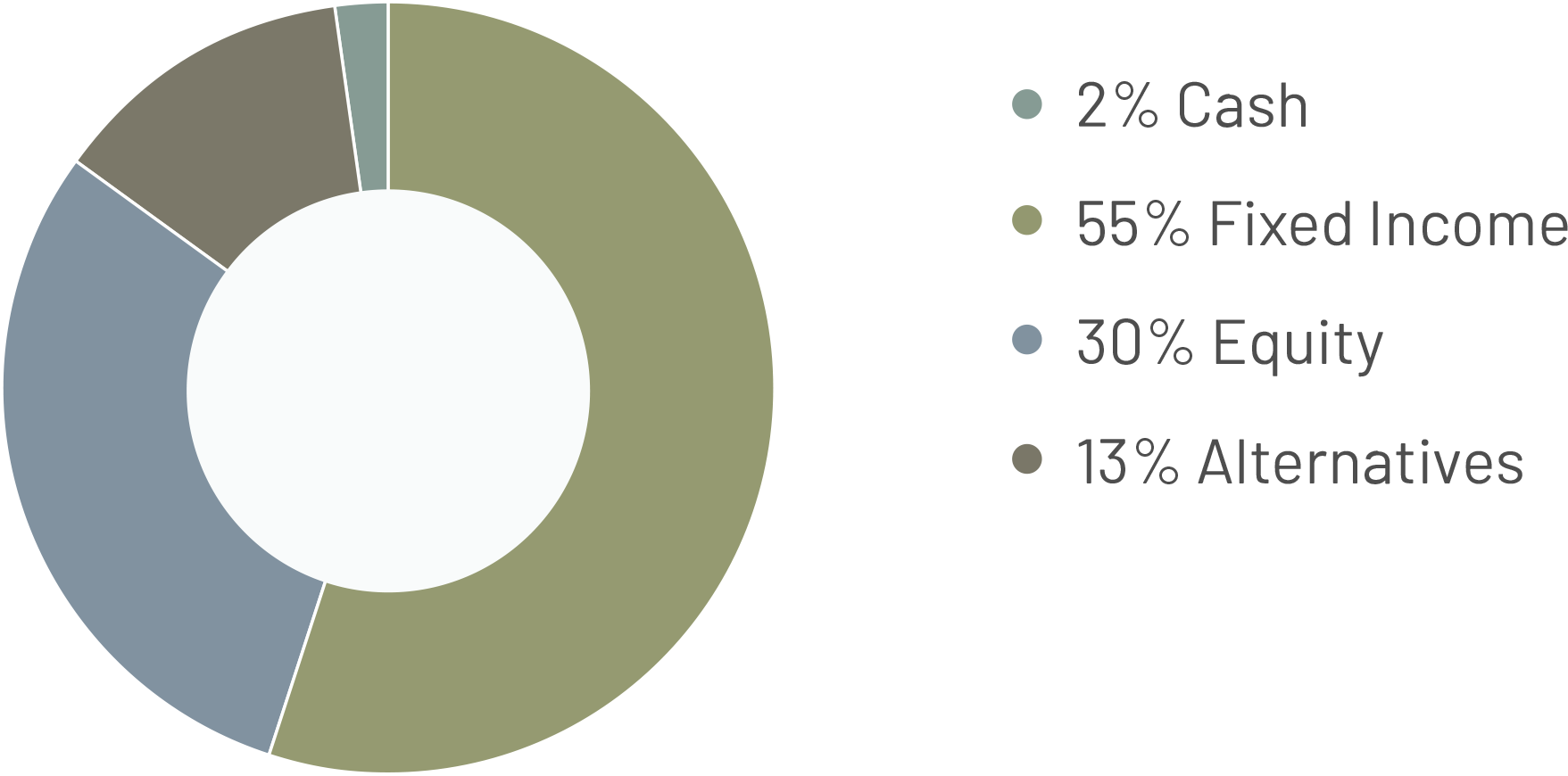

The Tactical Allocation series is our legacy series and invests portfolio assets in broadly diversified model portfolios that have the flexibility to allocate among a combination of asset classes, including mutual funds, ETFs and alternative assets for various investor risk portfolios.

60-75

45-60

35-55

30-50

10-30

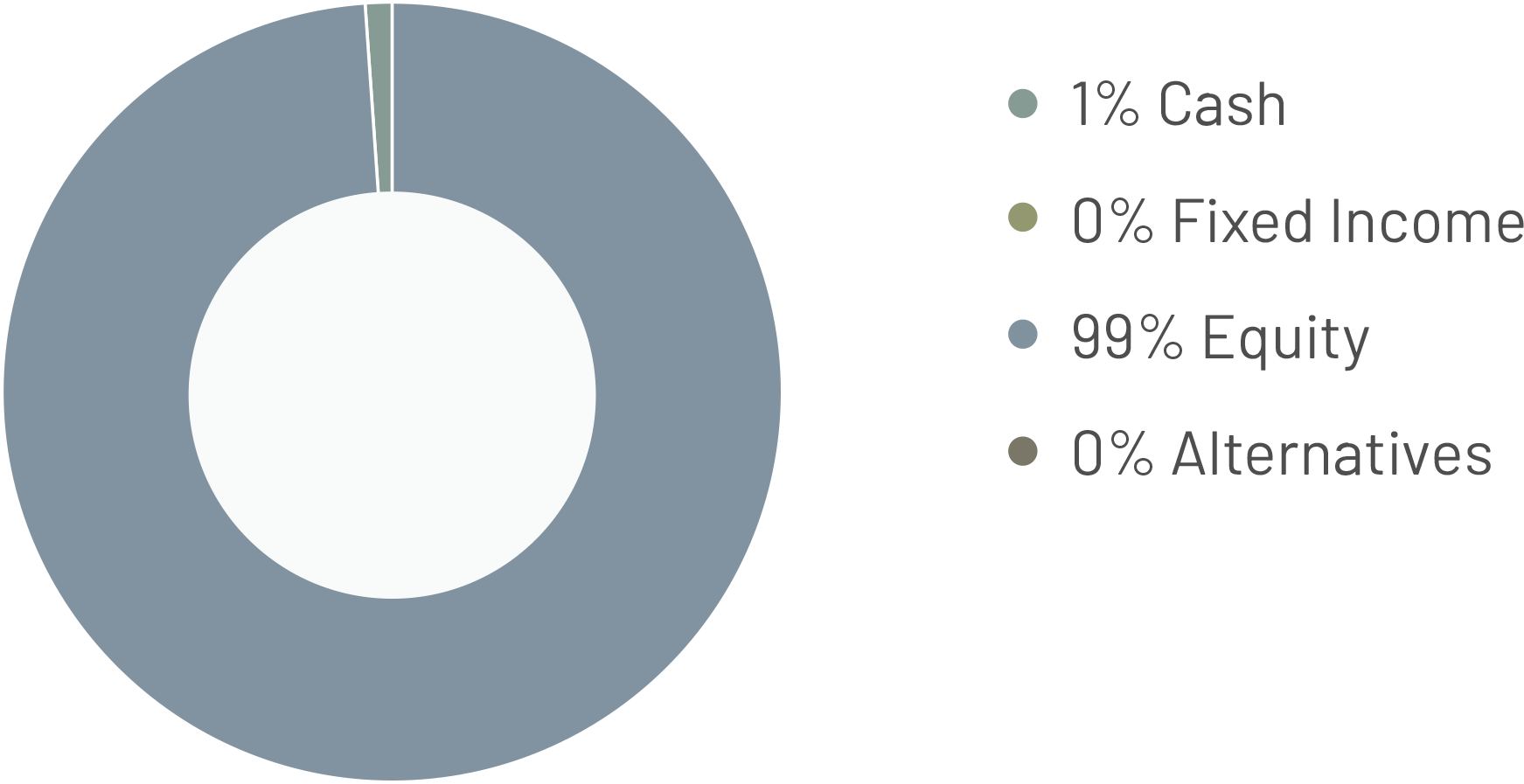

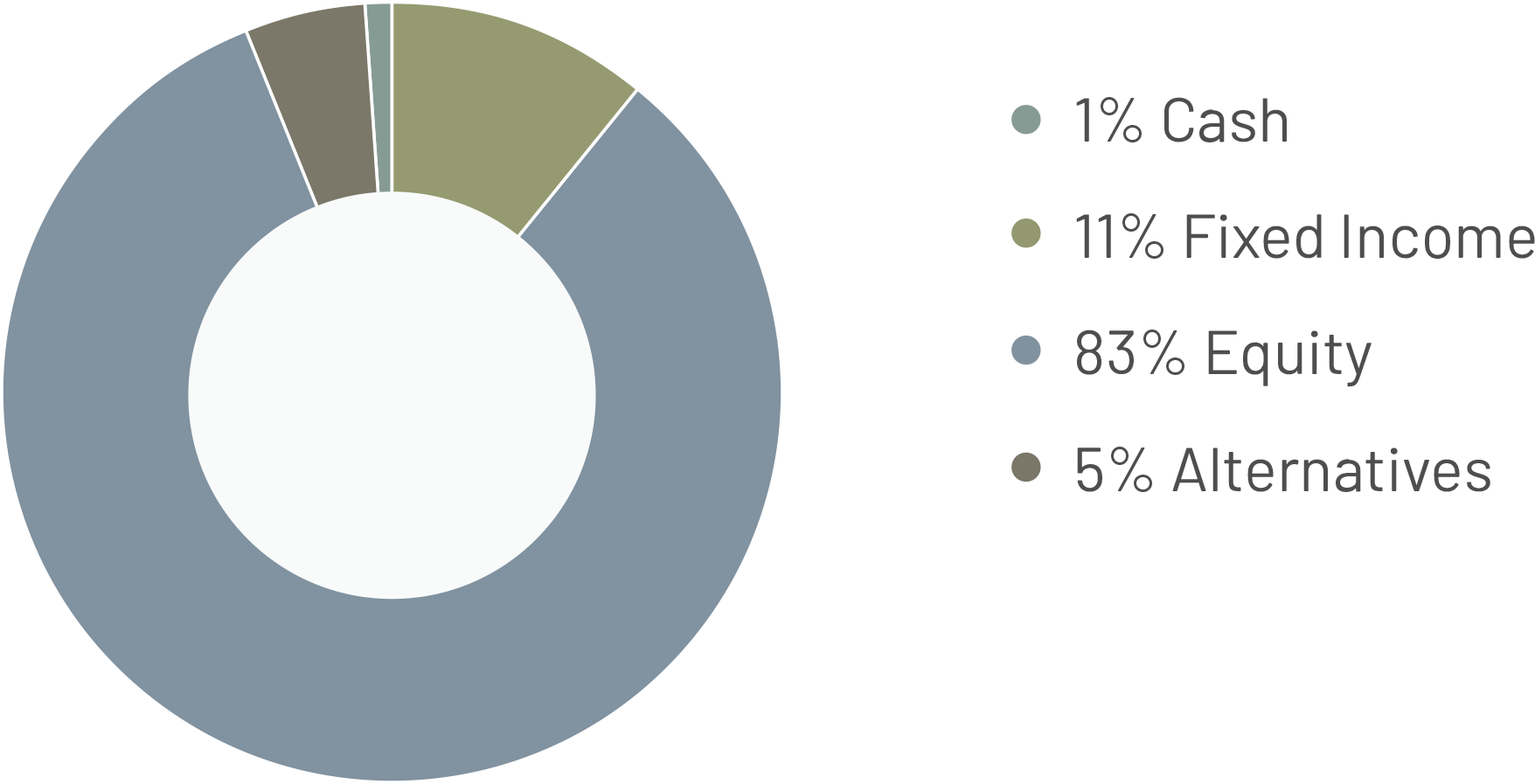

Our Core series invests portfolio assets in broadly diversified, low-cost ETFs. The model portfolios pursue a range of investment outcomes across a variety of asset classes and risk profiles.

75-95

65-85

45-65

25-45

10-30

Our Core Sector series invests portfolio assets in broadly diversified, lower-cost industry sector ETF model portfolios that pursue a range of investment outcomes for various investor risk profiles.

80-100

75-95

55-75

45-65

25-45

Our Income series seeks to produce income for various investor risk profiles by combining fixed income ETFs with dividend-paying equity ETFs.

65-85

45-65

20-40

5-25

Our ESG series invests portfolio assets in ETFs that have strong ESG ratings. Investments are evaluated on a company’s financial standing as well as environmental, social, and corporate governance factors.

60-80

45-65

35-55

15-35

Many of our investment strategies and models have earned industry recognition and high rankings.

VIEW OUR AWARDS HISTORY